Before you enroll in any 401(k), please consider the following:

- Limited Investment Options: Many 401(k) plans offer a limited selection of investment options, which may restrict your ability to diversify your portfolio according to your preferences or risk tolerance.

- Limited contribution limits: While 401(k) contribution limits are relatively high compared to other retirement accounts, they may not be sufficient for individuals who want to save more aggressively for retirement.

- Fees and Expenses: Some 401(k) plans may charge administrative fees, management fees, and other expenses, which can eat into your investment returns over time.

- Early Withdrawal Penalties: Withdrawing funds from a 401(k) before retirement age (usually before 59½) typically incurs early withdrawal penalties, which can erode your savings significantly.

- Required minimum distributions (RMDs): Once you reach the age of 72 (or 70½ if you were born before July 1, 1949), you are required to start taking minimum distributions from your 401(k) each year, which are subject to income tax. Failure to take these distributions can result in significant penalties.

- Employer control: Your employer ultimately controls the 401(k) plan, including the investment options available and any matching contributions. This lack of control can be a disadvantage if the plan does not align with your financial goals or if your employer makes changes to the plan that negatively affect your investments.

- Employer Benefits: Employers enjoy the benefit of their contribution in the form of a tax write-off. That is to say tax deductible.

- Tax Implications: Contributions to a traditional 401(k) are made on a pre-tax basis, meaning you’ll owe income tax on withdrawals during retirement. Roth 401(k) contributions are made with after-tax dollars, but withdrawals of earnings may be taxable.

- Rollover Complexity: When changing jobs, you may need to roll over your 401(k) balance into a new employer’s plan or an individual retirement account (IRA), which can be a complex process and may result in fees or tax implications if not done correctly.

- Market risk: Like any investment, 401(k) plans are subject to market risk. The value of your investments can fluctuate based on market conditions, potentially leading to losses, especially if you are heavily invested in stocks or other volatile assets.

- No Guarantee of Returns: Like any investment, there’s no guarantee that your 401(k) investments will generate positive returns, and market fluctuations can impact the value of your account.

Bottom line: Why would you invest in a vehicle that you: Cannot control, have limited contribution, cannot have early withdrawal unless penalized and you may end up most or even all your money?!

What if you are already enrolled in a 401K? Here are your options:

- DO NOT CONTRIBUTE MORE THAN YOUR EMPLOYER. We cannot stress on this point enough. The market can eliminate up to 50% of your nest. So, technically, what you lost is your employer’s money not yours. This may give you some peace of mind, yet not guaranteed. If you are already contributing more than your employer, we highly recommend that you stop it NOW.

- AVOID THE HYPE: You will always, specially during election years, hear that the market has increase 10% or 20% percent or or. Great, but from which point? Low point or the high point? The media will always take the lowest point as a reference. Please always search exactly which point are they referring to and most important: do not take it for granted. Always do your own research. The devil is always in the details.

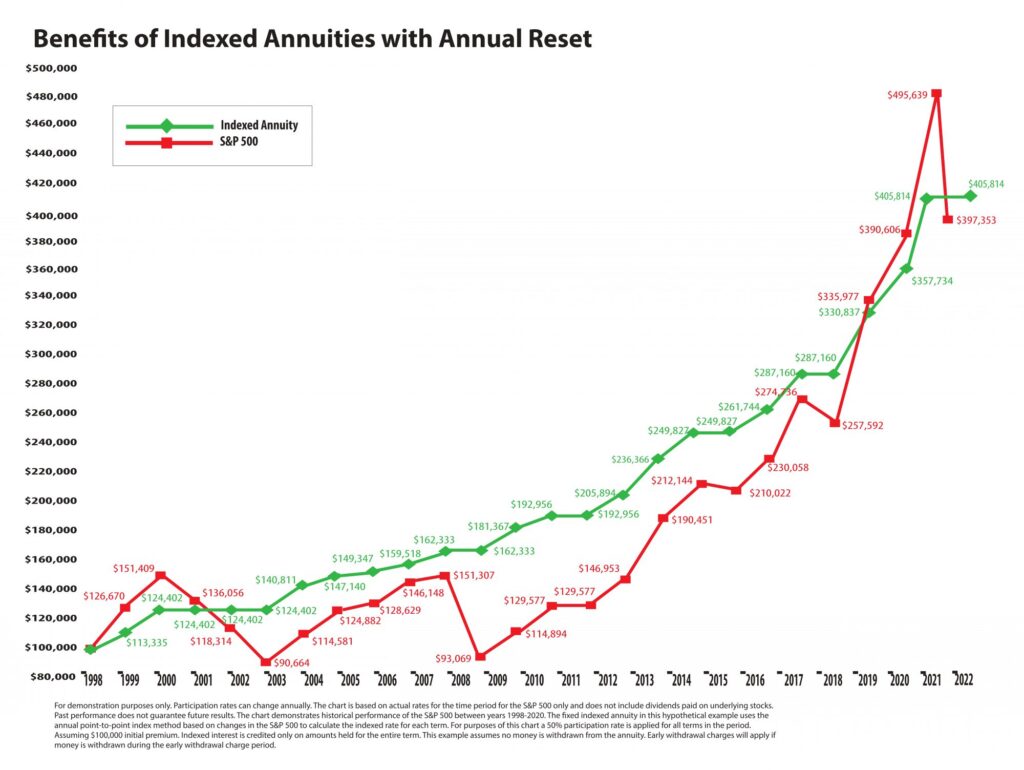

- Please consider the picture attached. This is a real life inheritance of $100,000.00 for a 31 year old client will real market performance for one of the products that we offer.

If you have more disposable income or more money to invest, contact us for a free consultation. Our model is not only diversification, but multiplication by creating multiple streams of income. Not everyone will qualify and depending on where you are in your career and your retirement goals. Our team of highly skilled specialists, will work with you to develop a plan that will guide and help you achieve these goals. To learn more about these and other benefits, please fill out the form below today and one of our licensed agents in your area will contact you. We look forward to hearing from you!

Note: Not all benefits are available in every state. Please ask your insurance specialist for more details.