Before you start a 529 for your kids college, please consider the following:

- High Cost: 529 plans come with a variety of fees, such as management fees and administrative fees. These costs can eat into your overall returns over time. The investment options within a 529 plan may also have high expense ratios. These fees can significantly impact your long-term savings goals.

- Limited Investment Options: Many 529 plans have a restricted selection of investment options. This can limit your ability to diversify your portfolio and potentially earn higher returns. Some plans may not offer the flexibility to adjust your investments as needed. This lack of control can be a disadvantage for those who want more control over their savings.

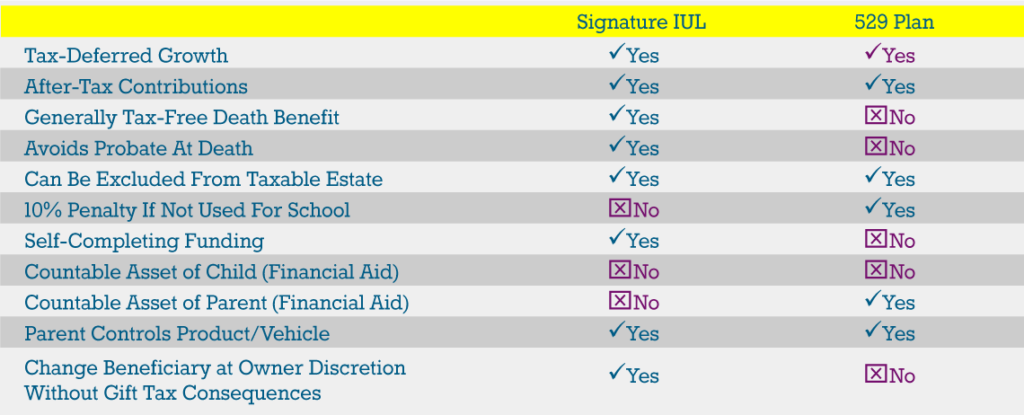

- Tax Implications: While contributions to a 529 plan are tax-deductible in some states, withdrawals may be subject to taxes and penalties. This can eat into your savings if you need to access the funds for non-educational expenses. Additionally, using funds for non-qualified expenses may result in tax consequences. This can be a significant drawback for individuals who need to use the funds for other purposes.

- Impact on Financial Aid: Funds held in a 529 plan can impact a student’s eligibility for financial aid. This can be a disadvantage for families who rely on financial aid to pay for education expenses. Some colleges may treat funds in a 529 plan differently than other assets, potentially reducing aid eligibility. This can be a major drawback for families trying to maximize their financial aid options.

Bottom line: Why would you invest in a vehicle that you: Cannot control, have limited contribution, high cost which will eat into your investment, must be spend on education only and you will be penalized and taxed to death if your kid decided not to go to college?!

If you have more disposable income or more money to invest, contact us for a free consultation. Our model is not only diversification, but multiplication by creating multiple streams of income. Not everyone will qualify and depending on where you are in your career and your retirement goals. Our team of highly skilled specialists, will work with you to develop a plan that will guide and help you achieve these goals. To learn more about these and other benefits, please fill out the form below today and one of our licensed agents in your area will contact you. We look forward to hearing from you!

Note: Not all benefits are available in every state. Please ask your insurance specialist for more details.

[contact-form-7 id=”1c2d196″ title=”Contact form”]